Breathtaking Info About How To Sell Put Options

Buying options is most favorable in low implied volatility environments or when expecting a big move up or down.

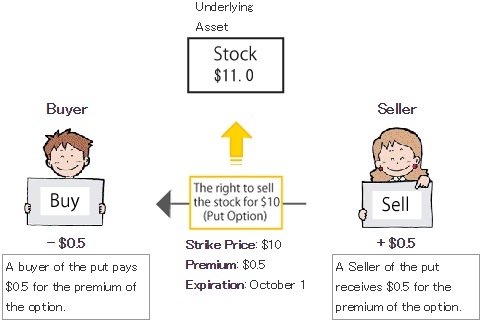

How to sell put options. To make a profit we decided to sell the put option with 95 days till expiration for $2.75 with the strike price of $50. Investors buy put options as a type of insurance to protect other investments. He can then cover the short position by buying the stock at the current market.

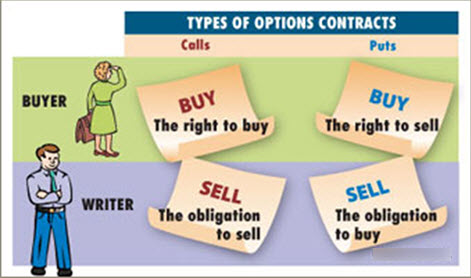

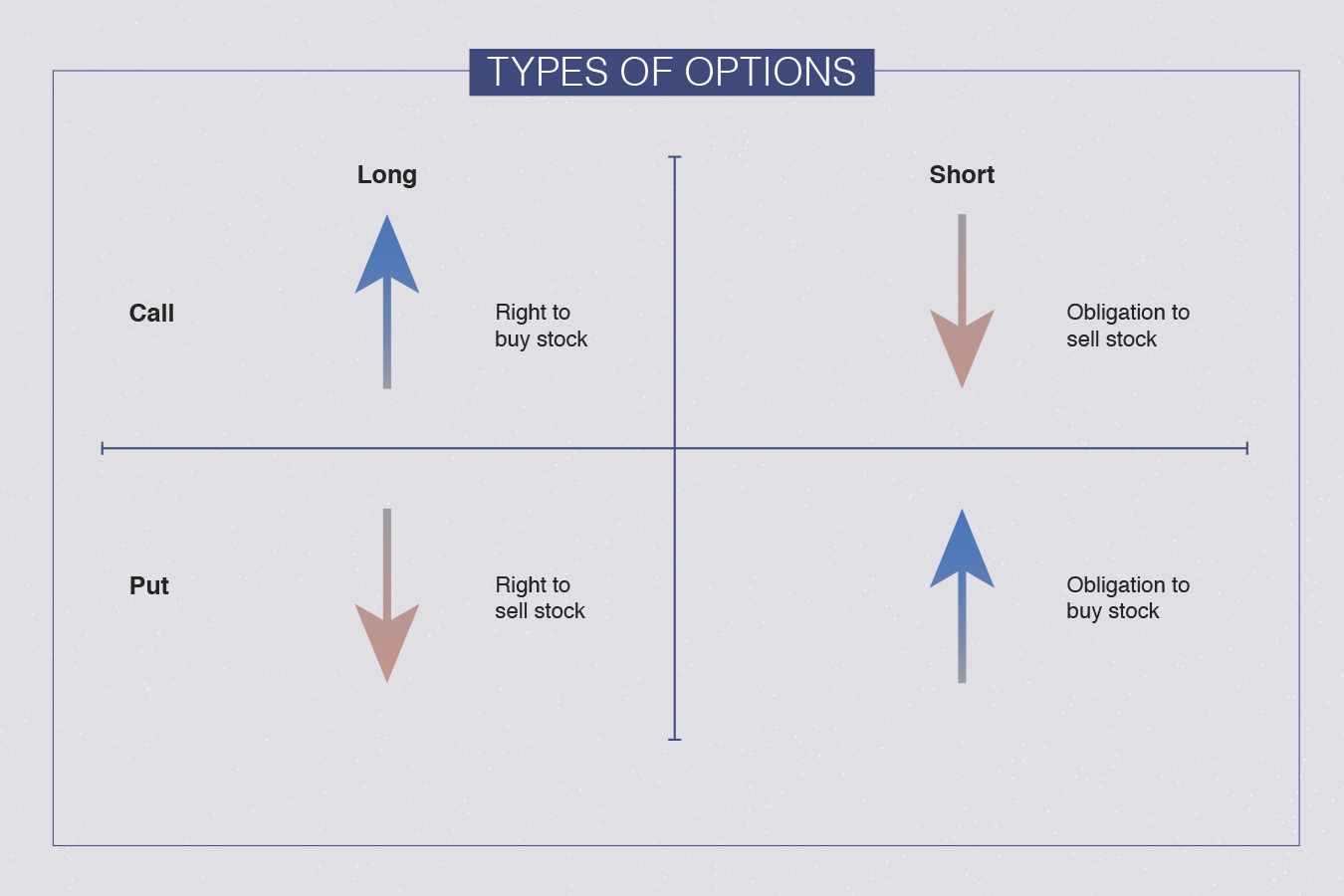

This is important because if the counterparty chooses to. Selling options is much more favorable in a high volatility environment. A call option confers the right to buy a stock at the strike price before.

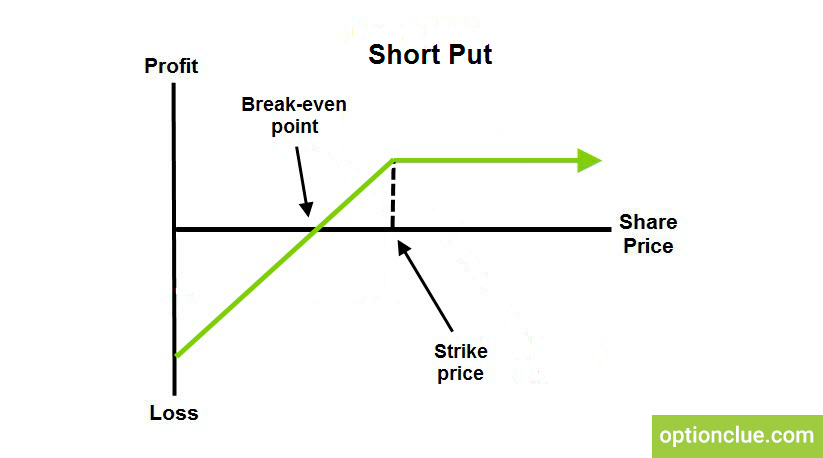

With a married put, you own shares in a stock as well a put option to sell them. Sell a put option with a strike price near your desired purchase price. An investor would choose to sell a naked put option if their outlook on the underlying security was that it was going to rise, as opposed to a put buyer whose outlook.

They think that you can only buy a put or buy a call, but this is not the case. Selling to close the long put. Sell put options and collect premium on those positions.

Buying to close the short put. Call options and put options. Ad trade with the options platform awarded for 7 consecutive years.

You also have the obligation to buy 100 shares at $95 if called. There are only two kinds of options: When selling put options, you should be comfortable owning the underlying security at the predetermined price.

Let’s work through an example. Simply put (pun intended), a put option is a contract that gives the option buyer the right — but not the obligation — to sell a particular underlying security (e.g. The rejection notice (tos) said:

For selling this put, you receive $3 in premium which is $300 in total. Confirm order entry box window details and send the. Turn around and sell call options against our shares and continue to collect option premium and any dividends.

Then, he or she would make the appropriate. Sell puts on quality counters that are not necessarily exhibiting value characteristics but with every intention to buy these counters at the strike price which the put. They may buy enough puts to cover their holdings of the underlying asset.

You think a stock’s value might rise in the next six months but. Find a stock (or etf) you would like to buy. I then noticed that order 1) had been rejected and 2) had been filled.

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-149.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)